Hardware power tools industry development status, global market growth is slow

Release Time:

Sep 01,2021

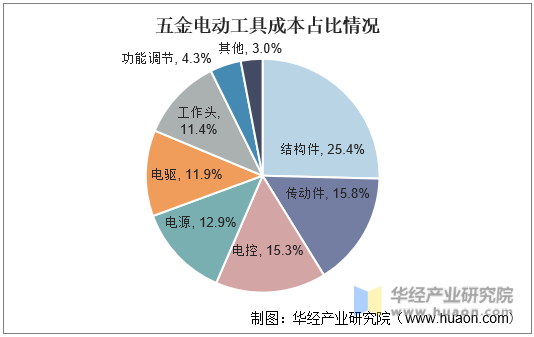

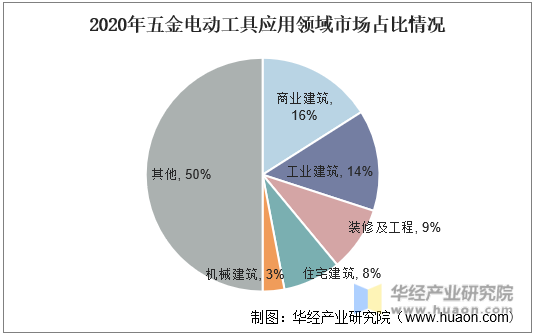

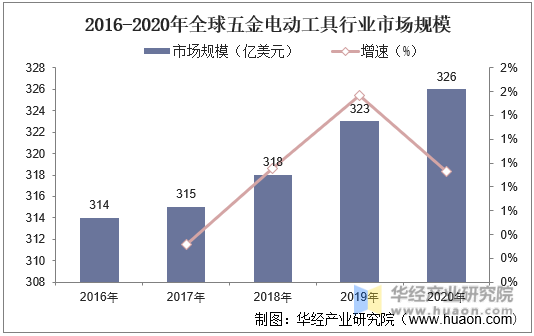

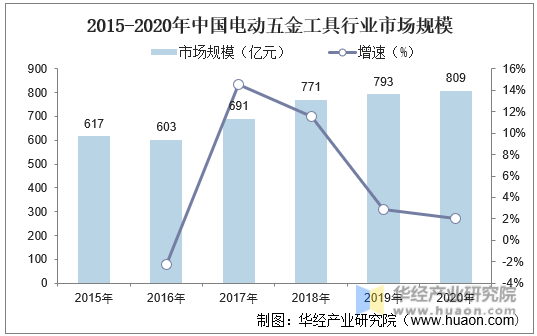

1. Hardware Power Tools Overview Power tools are mainly divided into metal cutting, grinding, assembly and railway power tools by use. Common power tools are electric drills, electric grinders, electric wrenches, electric screwdrivers, electric hammers, electric drills, concrete vibrators, electric planers, etc. Electric tools can be divided into professional grade, work grade and general grade according to the level, of which hardware electric tools are general grade. In the cost of hardware electric tools, structural parts account for 25.4 of the total cost of hardware electric tools, accounting for the highest proportion. The second is transmission parts, electric control, power supply, electric drive and working head, accounting for 15.8, 15.3, 12.9, 11.9 and 11.4 respectively. These components account for more than 10% of the total cost of hardware tools. The proportion of the cost of power tools. 2. hardware electric tools application field There are many downstream application industries in the hardware power tool market, with a stable and huge market, downstream applications include manufacturing and processing, assembly, construction, housing decoration, repair (automobiles, home appliances, etc.), home furnishings, etc. According to the data, the application proportion of global power tools in the construction industry is as high as 50%, of which commercial construction, industrial construction, decoration and engineering, residential construction and mechanical construction account for 15.9, 14%, 9%, 8.1 and 3% respectively. 3. hardware electric tools industry market size According to the data, the market size of the global hardware and electric tools industry is on the rise from 2016 to 2020. In 2016, the market size of the global hardware and electric tools industry is 31.4 billion US dollars, increasing to 32.6 billion US dollars by 2020, and only 1.2 billion US dollars from 2016 to 2020, with an average annual growth rate of 0.3 billion US dollars. The growth rate is relatively small, mainly due to the maturity of the hardware and electric tools industry market, mainly from developing countries such as Asia and Africa, but these developing countries. With the development of China's economy, the demand for hardware tools is also rising. According to the data, the market size of China's power tools in 2020 is about 80.9 billion yuan, and the compound growth rate from 2015 to 2020 is 6.9. It is expected that the growth rate of the industry will decline slightly in the next five years, but the total market volume will still maintain growth. The market size of electric tools can reach 93.7 billion yuan in 2025, and the compound growth rate from 2021 to 2025 will be about 3%. 4. hardware electric tools industry related enterprises Typical manufacturers in mainland China include Dongcheng Group, Baoshi Group, etc., but they are relatively low-profile in the world, mainly manufacturing low-end products, and their market share is much lower than overseas and Hong Kong manufacturers. The more well-known domestic power tool manufacturers include Suzhou Baoshi, Nanjing Quanfeng Group, etc.

1. Hardware Power Tools Overview

Power tools are mainly divided into metal cutting, grinding, assembly and railway power tools by use. Common power tools are electric drills, electric grinders, electric wrenches, electric screwdrivers, electric hammers, electric drills, concrete vibrators, electric planers, etc. Electric tools can be divided into professional grade, work grade and general grade according to the level, of which hardware electric tools are general grade.

InIn the cost of hardware electric tools, structural parts account for 25.4 of the total cost of hardware electric tools, accounting for the highest proportion. The second is transmission parts, electric control, power supply, electric drive and working head, accounting for 15.8, 15.3, 12.9, 11.9 and 11.4 respectively. These components account for more than 10% of the total cost of hardware tools.

The proportion of the cost of power tools.

2. hardware electric tools application field

There are many downstream application industries in the hardware power tool market, with a stable and huge market, downstream applications include manufacturing and processing, assembly, construction, housing decoration, repair (automobiles, home appliances, etc.), home furnishings, etc. According to the data, the application proportion of global power tools in the construction industry is as high as 50%, of which commercial construction, industrial construction, decoration and engineering, residential construction and mechanical construction account for 15.9, 14%, 9%, 8.1 and 3% respectively.

3. hardware electric tools industry market size

According to the data, the market size of the global hardware and electric tools industry is on the rise from 2016 to 2020. In 2016, the market size of the global hardware and electric tools industry is 31.4 billion US dollars, increasing to 32.6 billion US dollars by 2020, and only 1.2 billion US dollars from 2016 to 2020, with an average annual growth rate of 0.3 billion US dollars. The growth rate is relatively small, mainly due to the maturity of the hardware and electric tools industry market, mainly from developing countries such as Asia and Africa, but these developing countries.

With the development of China's economy, the demand for hardware tools is also rising. According to the data, the market size of China's power tools in 2020 is about 80.9 billion yuan, and the compound growth rate from 2015 to 2020 is 6.9. It is expected that the growth rate of the industry will decline slightly in the next five years, but the total market volume will still maintain growth. The market size of electric tools can reach 93.7 billion yuan in 2025, and the compound growth rate from 2021 to 2025 will be about 3%.

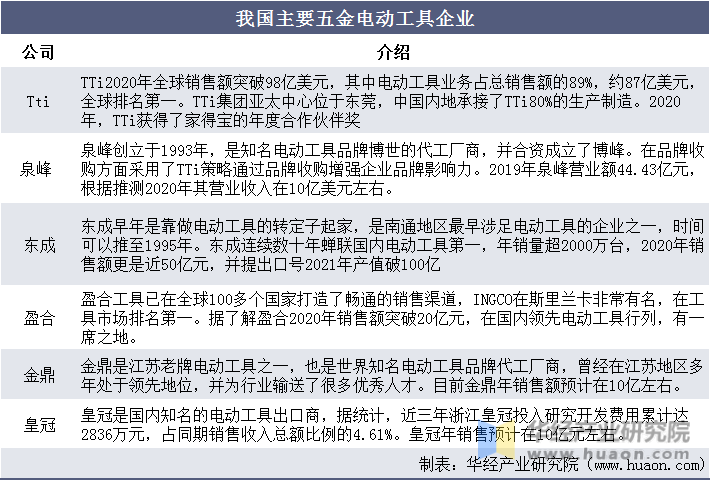

4. hardware electric tools industry related enterprises

Typical manufacturers in mainland China include Dongcheng Group, Baoshi Group, etc., but they are relatively low-profile in the world, mainly manufacturing low-end products, and their market share is much lower than overseas and Hong Kong manufacturers. The more well-known domestic power tool manufacturers include Suzhou Baoshi, Nanjing Quanfeng Group, etc.

Key words: